Permanent Insurance Solutions: Financial Alternatives for a Secure Future

In today's uncertain financial landscape, securing your future is more important than ever. Permanent insurance solutions provide a powerful tool to protect your family, accumulate wealth, and plan for retirement. This comprehensive article will explore the different types of permanent insurance options available, their advantages and disadvantages, and how to determine the best solution for your unique financial needs.

5 out of 5

| Language | : | English |

| File size | : | 945 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 13 pages |

| Lending | : | Enabled |

Types of Permanent Insurance

There are two main types of permanent insurance: life insurance and annuities.

Life Insurance

Life insurance provides a death benefit to your beneficiaries upon your passing. It can be used to:

- Provide financial security for your family

- Pay for funeral expenses

- Cover outstanding debts

- Fund a trust for your children's education

There are several types of life insurance policies, including:

- Term life insurance: Provides coverage for a specific period of time, such as 10, 20, or 30 years.

- Whole life insurance: Provides lifelong coverage and builds cash value over time.

- Universal life insurance: A flexible policy that allows you to adjust your coverage amount and premium payments.

Annuities

Annuities are contracts that provide a stream of income payments over a specified period of time or for your lifetime. They can be used to:

- Supplement your retirement income

- Provide a steady income stream for life

- Protect against outliving your savings

There are different types of annuities, including:

- Immediate annuities: Begin making payments immediately.

- Deferred annuities: Payments are made at a later date, such as upon retirement.

- Variable annuities: Investment-linked annuities that offer the potential for growth.

Benefits of Permanent Insurance

Permanent insurance offers numerous benefits, including:

- Death benefit: Provides financial protection for your family in case of your untimely death.

- Cash value accumulation: Whole life and universal life policies accumulate cash value that can be borrowed against or withdrawn tax-free.

- Tax-deferred growth: Cash value grows tax-deferred inside the policy, allowing it to accumulate faster.

- Supplemental income: Annuities can provide a steady stream of income to supplement your retirement savings.

- Estate planning: Permanent insurance can help reduce estate taxes and ensure your wishes are carried out.

Considerations

Before purchasing a permanent insurance policy, it's important to consider the following factors:

- Purpose of coverage: Determine why you need permanent insurance and what you want it to cover.

- Insurance needs: Assess your current and future financial needs to determine the appropriate coverage amount.

- Policy type: Choose the type of permanent insurance that best fits your needs and goals.

- Premium affordability: Make sure you can comfortably afford the premiums over the life of the policy.

- Tax implications: Understand the tax consequences of different permanent insurance options.

Choosing the Right Solution

Determining the best permanent insurance solution for your needs involves careful consideration and professional guidance. A qualified financial advisor can help you assess your financial situation, discuss your goals, and recommend a personalized plan that meets your unique requirements.

Permanent insurance solutions offer a valuable tool for securing your financial future. By understanding the different types of policies available, their benefits, and considerations, you can make an informed decision that will protect your family, accumulate wealth, and provide peace of mind for years to come.

5 out of 5

| Language | : | English |

| File size | : | 945 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 13 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia John H Johnson

John H Johnson J T Skye

J T Skye Jacob Ward

Jacob Ward J A Rogers

J A Rogers Les Carter

Les Carter Jack Kelly

Jack Kelly Isabel Wroth

Isabel Wroth Isabella M Weber

Isabella M Weber Jacques Steinberg

Jacques Steinberg Teri Temple

Teri Temple Patti Rokus

Patti Rokus J P Singh

J P Singh Shanterra Mcbride

Shanterra Mcbride Isabel Santos

Isabel Santos Laura Albritton

Laura Albritton Marius Milu

Marius Milu Tobias Wolff

Tobias Wolff James Willis

James Willis Jason Tharp

Jason Tharp J Rishi Dadhichi

J Rishi Dadhichi

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Gustavo CoxThe Thin Art of Naming Elephants: How to Surface Undiscussables for Greater...

Gustavo CoxThe Thin Art of Naming Elephants: How to Surface Undiscussables for Greater...

Leslie CarterUnleash Your Inventive Spirit: An Immersive Journey into the Mind of James...

Leslie CarterUnleash Your Inventive Spirit: An Immersive Journey into the Mind of James... Colt SimmonsFollow ·19.2k

Colt SimmonsFollow ·19.2k Cruz SimmonsFollow ·5.5k

Cruz SimmonsFollow ·5.5k Adrien BlairFollow ·7.7k

Adrien BlairFollow ·7.7k Greg CoxFollow ·5.5k

Greg CoxFollow ·5.5k Nathaniel HawthorneFollow ·18.7k

Nathaniel HawthorneFollow ·18.7k Josh CarterFollow ·14.5k

Josh CarterFollow ·14.5k Jordan BlairFollow ·17.7k

Jordan BlairFollow ·17.7k Benji PowellFollow ·8.5k

Benji PowellFollow ·8.5k

Phil Foster

Phil FosterThe Unforgettable Easter: Ramona's Journey of Discovery...

Embark on Ramona's Extraordinary Easter...

Levi Powell

Levi PowellThe Old City and Mount of Olives: A Journey Through...

Jerusalem, a city etched into the annals of...

Henry Hayes

Henry HayesThe Clearances: A Journey Through Scotland's Hidden...

In the 18th and 19th...

Edward Reed

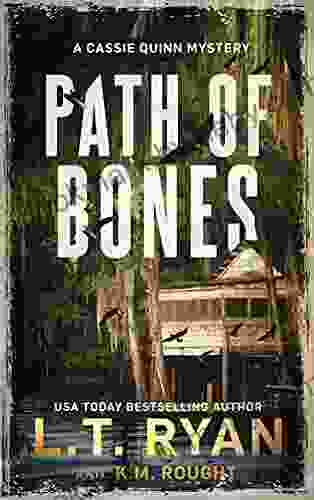

Edward ReedUnravel the Enigmatic 'Path of Bones' with Cassie Quinn...

Step into the...

5 out of 5

| Language | : | English |

| File size | : | 945 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 13 pages |

| Lending | : | Enabled |