Unlocking Real Estate Investment Opportunities with REITs: A Comprehensive Guide

In the ever-evolving financial landscape, investors are constantly seeking diversification and high-yield opportunities. Real estate has long been a sought-after asset class, but navigating the complexities of direct property ownership can present significant challenges. Enter real estate investment trusts (REITs),a groundbreaking investment vehicle that provides access to the lucrative world of real estate without the hassles of direct ownership.

4.4 out of 5

| Language | : | English |

| File size | : | 3748 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 533 pages |

| Lending | : | Enabled |

This comprehensive guide will delve into the realm of REITs, empowering you with the knowledge and strategies to unlock their full potential as part of a well-rounded investment portfolio. We'll explore the structure, benefits, and risks of REITs, and equip you with expert insights and best practices to maximize your returns.

Understanding the Structure of REITs

REITs are hybrid investment instruments that combine the liquidity of stocks with the income-generating potential of real estate. They are companies that own, finance, or operate income-producing real estate, and distribute the majority of their taxable income to shareholders in the form of dividends.

REITs are structured as either equity REITs or mortgage REITs. Equity REITs invest in physical real estate properties, such as apartments, office buildings, and shopping malls. Mortgage REITs, on the other hand, invest in mortgages secured by real estate properties.

Benefits of Investing in REITs

REITs offer a multitude of benefits that make them an attractive investment choice:

- Diversification: REITs provide exposure to the real estate market, diversifying your portfolio and reducing overall risk.

- Passive Income: REITs are required to distribute at least 90% of their taxable income to shareholders as dividends, providing a steady stream of passive income.

- Inflation Hedge: Real estate tends to appreciate in value over time, making REITs a good hedge against inflation.

- Liquidity: REITs are publicly traded on exchanges, offering investors liquidity and the ability to buy and sell shares easily.

- Tax Advantages: Some REITs may qualify for special tax treatments, such as the ability for shareholders to defer capital gains tax.

Risks of Investing in REITs

While REITs offer numerous benefits, it's important to acknowledge the potential risks involved:

- Market Volatility: REITs are subject to market fluctuations and can experience price declines during economic downturns.

- Interest Rate Risk: Interest rate changes can impact REIT performance, especially for mortgage REITs.

- Property Concentration: Some REITs may invest heavily in a specific property type or geographic location, increasing their vulnerability to risk.

- Liquidity Risk: While REITs are generally liquid, during periods of market stress, liquidity may be reduced.

Expert Strategies for Successful REIT Investing

To maximize your returns and mitigate risks, consider the following expert strategies when investing in REITs:

- Diversify Your Holdings: Invest in a variety of REITs across different property types and geographic locations to reduce risk.

- Consider the Dividend Yield: While a high dividend yield can be attractive, it's important to evaluate the sustainability of the dividend in relation to the REIT's earnings.

- Perform Due Diligence: Research the REIT's management team, financial performance, and investment strategy before investing.

- Monitor Interest Rate Changes: Keep an eye on interest rate movements and their potential impact on REITs.

- Consider Active vs. Passive Management: Actively managed REITs may offer higher returns but come with higher fees. Passive REITs offer lower fees but potential returns may be more modest.

Empowering Investors with Bloomberg 141

Empower yourself with Bloomberg 141, a comprehensive platform that provides real-time data, news, and analysis on REITs and the broader real estate market. With cutting-edge tools and insights, Bloomberg 141 equips investors with the knowledge and confidence to navigate the world of REITs effectively.

Unlock the transformative power of real estate investment with this comprehensive guide to REITs. By understanding the structure, benefits, risks, and expert strategies, you can harness the potential of this dynamic asset class to diversify your portfolio, generate passive income, and achieve your financial goals.

Remember, investing involves risk, and it's essential to conduct thorough research and consult with a financial advisor before making any investment decisions.

4.4 out of 5

| Language | : | English |

| File size | : | 3748 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 533 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Jackie Robinson

Jackie Robinson Jacqueline Bance

Jacqueline Bance Melanie Mitchell

Melanie Mitchell Nancy Bardacke

Nancy Bardacke Wilma Holmes

Wilma Holmes Jakob Schneider

Jakob Schneider Johanna Lehner

Johanna Lehner Mista Nove

Mista Nove Nick Henck

Nick Henck Rosario Marin

Rosario Marin Jack Ewing

Jack Ewing Wendy Laura Belcher

Wendy Laura Belcher Margarida Araya

Margarida Araya Ronald Pratt

Ronald Pratt James Clarke

James Clarke Maaike Bleeker

Maaike Bleeker Jack Disbrow Gunther

Jack Disbrow Gunther Wendy Kopp

Wendy Kopp Jacqueline Davies

Jacqueline Davies Kathleen Buckstaff

Kathleen Buckstaff

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Wayne CarterEat Like a Local in Melbourne: Your Ultimate Guide to the Best Food in World...

Wayne CarterEat Like a Local in Melbourne: Your Ultimate Guide to the Best Food in World...

Harry CookUnlocking the Secrets of Social Security: Your Essential Guide to Retirement...

Harry CookUnlocking the Secrets of Social Security: Your Essential Guide to Retirement... VoltaireFollow ·5.4k

VoltaireFollow ·5.4k Gary CoxFollow ·14.4k

Gary CoxFollow ·14.4k Charles ReedFollow ·12.5k

Charles ReedFollow ·12.5k Hank MitchellFollow ·9.5k

Hank MitchellFollow ·9.5k Jamie BellFollow ·10.5k

Jamie BellFollow ·10.5k Ray BlairFollow ·11.2k

Ray BlairFollow ·11.2k Cody RussellFollow ·9k

Cody RussellFollow ·9k Colton CarterFollow ·9.1k

Colton CarterFollow ·9.1k

Phil Foster

Phil FosterThe Unforgettable Easter: Ramona's Journey of Discovery...

Embark on Ramona's Extraordinary Easter...

Levi Powell

Levi PowellThe Old City and Mount of Olives: A Journey Through...

Jerusalem, a city etched into the annals of...

Henry Hayes

Henry HayesThe Clearances: A Journey Through Scotland's Hidden...

In the 18th and 19th...

Edward Reed

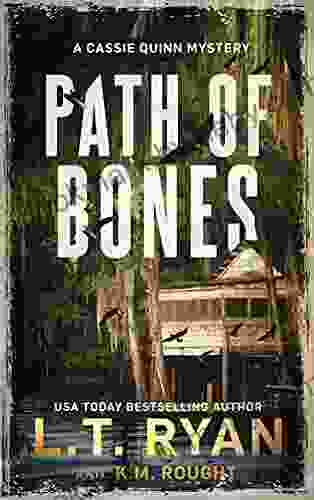

Edward ReedUnravel the Enigmatic 'Path of Bones' with Cassie Quinn...

Step into the...

4.4 out of 5

| Language | : | English |

| File size | : | 3748 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 533 pages |

| Lending | : | Enabled |