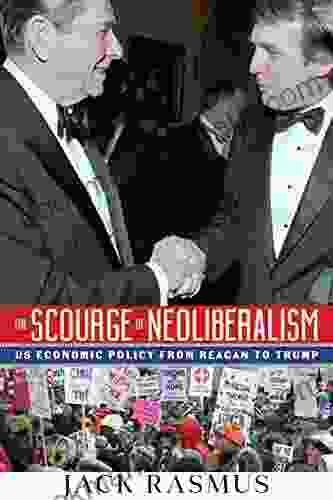

Understanding U.S. Economic Policy from Reagan to Trump

U.S. economic policy has undergone significant shifts over the past few decades, shaping the country's economic landscape and sparking ongoing debates. From the Reagan era's supply-side economics to the Trump administration's trade policies, each presidency has left its mark on the nation's fiscal and monetary policies. This article provides an in-depth analysis of U.S. economic policy from the Reagan era to the Trump administration, exploring the key policies implemented, their impact on the economy, and the ongoing debates surrounding their merits.

The Reagan Era: Supply-Side Economics and Deregulation

The Reagan administration's economic policies, often referred to as "Reaganomics," were characterized by a focus on supply-side economics and deregulation. Supply-side economics sought to stimulate economic growth by reducing taxes on businesses and high-income earners, with the belief that these tax cuts would encourage investment and job creation. Deregulation aimed to reduce government regulations on businesses, freeing them up to operate more efficiently and competitively.

4.2 out of 5

| Language | : | English |

| File size | : | 502 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 286 pages |

| Screen Reader | : | Supported |

Reagan's policies initially led to an economic boom, with GDP growth reaching an annual average of 4.5% from 1982 to 1989. However, the tax cuts and increased defense spending also resulted in a significant increase in the federal budget deficit. Despite the economic growth, income inequality widened during the Reagan era, as the benefits of the tax cuts disproportionately favored the wealthy.

The Clinton Era: Fiscal Discipline and Balanced Budgets

The Clinton administration shifted economic policy focus to fiscal discipline and balanced budgets. Clinton raised taxes on high-income earners and implemented spending cuts to reduce the federal budget deficit. The administration also pursued trade agreements, such as the North American Free Trade Agreement (NAFTA),to promote economic growth.

Clinton's economic policies contributed to a period of sustained economic growth and low unemployment rates. However, NAFTA and other trade agreements faced criticism for leading to job losses in certain sectors and increasing income inequality.

The Bush Era: Tax Cuts and the Great Recession

The Bush administration's economic policies largely continued the Reaganomics approach, with tax cuts and deregulation a key focus. The administration implemented two major tax cuts, in 2001 and 2003, and reduced regulations on businesses in various sectors.

While the tax cuts initially stimulated economic growth, they also contributed to a widening budget deficit. The deregulation of the financial industry played a significant role in the housing bubble and subsequent financial crisis of 2008, which led to the Great Recession.

The Obama Era: Recovery and the Affordable Care Act

The Obama administration's economic policies aimed to address the challenges of the Great Recession and implement healthcare reform. The administration implemented the American Recovery and Reinvestment Act, a stimulus package designed to boost economic activity, and the Affordable Care Act, which expanded health insurance coverage to millions of Americans.

The stimulus package and other measures helped to stabilize the economy and prevent a deeper recession. However, the Affordable Care Act faced significant opposition and political debate, particularly over its impact on healthcare costs and insurance coverage.

The Trump Era: Tax Cuts and Trade Protections

The Trump administration's economic policies were characterized by tax cuts and a focus on trade protections. The administration implemented a major tax cut in 2017, which reduced taxes on businesses and individuals. The administration also renegotiated trade agreements, such as the USMCA (United States-Mexico-Canada Agreement),and imposed tariffs on imports from China and other countries.

The tax cuts have led to increased economic growth and corporate profits, but they have also contributed to a growing budget deficit. The trade policies have drawn mixed reactions, with some arguing they protect American jobs and others criticizing their impact on consumers and businesses.

Ongoing Debates

The debates surrounding U.S. economic policy continue today, with different perspectives on the effectiveness and fairness of various policies. Some argue that supply-side economics and tax cuts stimulate economic growth and create jobs, while others contend that they benefit the wealthy at the expense of the middle class and the poor. The debate over trade policy also persists, with arguments for protecting American jobs and industries against arguments for free trade and global economic integration.

Fiscal policy remains a key topic of debate, with discussions centering on the appropriate level of government spending and taxation to promote economic growth and ensure social welfare. Monetary policy, controlled by the Federal Reserve, also plays a significant role in regulating the economy, and debates continue over the optimal interest rate levels to achieve price stability and full employment.

U.S. economic policy from the Reagan era to the Trump administration has undergone significant changes, reflecting the evolving economic challenges and political priorities of each presidency. The implementation of supply-side economics, deregulation, fiscal discipline, trade agreements, stimulus packages, and tax cuts has had varying impacts on the economy and society. The ongoing debates surrounding these policies highlight the complexities and challenges of economic policy-making, as policymakers strive to balance economic growth, job creation, social welfare, and fiscal responsibility.

4.2 out of 5

| Language | : | English |

| File size | : | 502 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 286 pages |

| Screen Reader | : | Supported |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia James A Perez

James A Perez Tracy Deonn

Tracy Deonn Jack Weatherford

Jack Weatherford Lane Diamond

Lane Diamond Jamal Moustafaev

Jamal Moustafaev Mimi Robinson

Mimi Robinson Jay Wengrow

Jay Wengrow Kathleen Buckstaff

Kathleen Buckstaff Luke Schumacher

Luke Schumacher Jack Andraka

Jack Andraka Orestes Lorenzo

Orestes Lorenzo James Cartwright

James Cartwright Stephen Graham Jones

Stephen Graham Jones T S Eliot

T S Eliot J A Konrath

J A Konrath William C Dear

William C Dear Ira K Wolf

Ira K Wolf Jake Black

Jake Black James Dodson

James Dodson Jim Marggraff

Jim Marggraff

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

J.D. SalingerKibbutz Joseph Birchall: A Testament to British Idealism and the Spirit of...

J.D. SalingerKibbutz Joseph Birchall: A Testament to British Idealism and the Spirit of...

Wayne CarterEat Like a Local in Melbourne: Your Ultimate Guide to the Best Food in World...

Wayne CarterEat Like a Local in Melbourne: Your Ultimate Guide to the Best Food in World... Carl WalkerFollow ·19.5k

Carl WalkerFollow ·19.5k Gerald ParkerFollow ·14.5k

Gerald ParkerFollow ·14.5k Arthur C. ClarkeFollow ·17.6k

Arthur C. ClarkeFollow ·17.6k Ervin BellFollow ·14.4k

Ervin BellFollow ·14.4k Jacob HayesFollow ·12.5k

Jacob HayesFollow ·12.5k Wayne CarterFollow ·9.7k

Wayne CarterFollow ·9.7k Charlie ScottFollow ·17k

Charlie ScottFollow ·17k Adrian WardFollow ·13.5k

Adrian WardFollow ·13.5k

Phil Foster

Phil FosterThe Unforgettable Easter: Ramona's Journey of Discovery...

Embark on Ramona's Extraordinary Easter...

Levi Powell

Levi PowellThe Old City and Mount of Olives: A Journey Through...

Jerusalem, a city etched into the annals of...

Henry Hayes

Henry HayesThe Clearances: A Journey Through Scotland's Hidden...

In the 18th and 19th...

Edward Reed

Edward ReedUnravel the Enigmatic 'Path of Bones' with Cassie Quinn...

Step into the...

4.2 out of 5

| Language | : | English |

| File size | : | 502 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 286 pages |

| Screen Reader | : | Supported |